With Halloween now firmly in our rearview mirror, my family’s once burgeoning candy surplus had finally depleted – or so I thought. Just when I thought the Halloween candy was long gone, my oldest son, like a pig scrounging for a truffle, managed to discover one more elusive chocolate bar from somewhere in our dining room. Like a grizzled prospector finding a gold nugget, he excitedly held the tiny candy bar aloft between two fingers as he wandered into our kitchen. Of course, our youngest son quickly took note, and my wife and I soon found ourselves in a bit of a pickle. Two kids. One tiny piece of candy. We knew that there was a good chance that one of our boys was about to be very unhappy.

Many U.S. citizens found themselves in a similar binary situation heading into the Presidential Election on November 5th. With this election, there seemed to be very little middle ground, and many voters were either going to be elated or distraught depending on which party took the White House. Unlike the 2020 election, the ultimate outcome didn’t take days or weeks to materialize, and the race was called for Donald Trump on the evening of November 5th with Vice President, Kamala Harris, officially conceding the election on November 6th. Furthermore, not only did Republicans gain the White House, but they also took control of the House and Senate in this election cycle, thus completing what pundits have dubbed the ‘red sweep’.

For many months here at Entrepreneur Aligned, we’ve been pondering the What If’s around the election and how certain policy initiatives of each candidate might impact financial markets. While there’s still a great deal of uncertainty, this election result gives us a bit more clarity on the potential path forward for fiscal policy. So, in this month’s letter, we’ll delve into some of the policies proposed and promises made by President-elect Donald Trump and try to provide a perspective on what these initiatives might mean for the U.S. economy and financial markets. We’ll start with what we deem to be potentially one of the most impactful fiscal initiatives touted by Donald Trump on the campaign trail – tariffs.

Tariffs & Trade

It’s probably a good idea to start by channeling my college ECON professors to outline what a tariff is, why tariffs are utilized, who pays for them, and the risks and opportunities that may emerge when tariffs are enacted.

At a basic level, a tariff is a tax on goods imported from overseas. A government might impose tariffs for any number of reasons, including to protect domestic producers/manufacturers, to protect consumers, to raise revenues, or as a punitive response to the actions of another government (i.e. national security reasons).

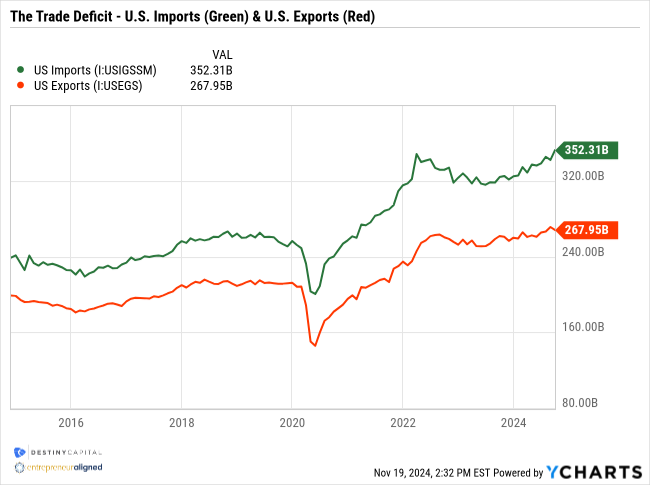

Throughout his first term as president, Donald Trump appeared to express great concern about the U.S. trade deficit. A trade deficit materializes when the U.S. imports more than it exports. As you can see in the chart below, the U.S. imports roughly $352 billion of goods and services each month while exporting $267 billion, resulting in a trade deficit of roughly $84 billion.

As a part of his ‘America First’ platform, Donald Trump has shown great interest in closing the trade deficit and boosting domestic production, and he believes that tariffs are a tool that may help to facilitate these goals. Therefore, on the campaign trail, Donald Trump spoke of implementing a universal tariff of 10% (or more) on all imports coming into the U.S. as well as a potential tariff of 60% on all Chinese imports. There have also been industry-specific references to tariffs, such as a 100% (or more) tariff on cars from Mexico or other products that move manufacturing from the U.S. to Mexico or elsewhere. This approach to trade policy may certainly help to bolster domestic production and could help to close the trade deficit, but there are also potential tradeoffs to consider.

The Potential Risks of Universal Tariffs

At this point, it’s important to note that tariffs are paid by importers (U.S. corporations), not by a country exporting goods. Therefore, are tariffs a good or a bad thing? Well, the answer to that question likely depends on your perspective.

For domestic producers, tariffs can be a wonderful thing as it hinders foreign competition and encourages domestic production. For example, domestic avocado producers would likely benefit from a tariff that suddenly made Mexican avocados more expensive than those grown in California. These domestic producers would likely achieve greater U.S. market share with demand that fosters future growth and expansion.

However, tariffs can cause significant economic impacts a bit further down the supply chain. Continuing the avocado hypothetical, let’s say that Chipotle purchases Mexican avocados at $1.00 each for the tons of guacamole the restaurant makes each day nationwide. They purchase imported avocados because domestically produced California avocados cost $1.05 each and there is virtually no difference in quality. However, let’s pretend that Congress implements a tariff that now makes Mexican avocados $1.10 each instead of $1.00. Therefore, Chipotle’s leadership decides to purchase avocados from California due to the post-tariff price difference.

No big deal, right? Well, if you’re Chipotle’s CFO, you’ll quickly note that the company was once paying $1.00 per avocado and is now paying a higher price of $1.05 each. Chipotle now has two options for how to deal with this. They can either absorb the added cost which may reduce profitability, or they can pass the expense on to consumers through price increases on their menu (or a bit of both).

As an investor, you do not want to see a decline in corporate profitability and, according to research from iCapital which is supported by data from Goldman Sachs, Morgan Stanley, Citi, Barclays, and more, it is estimated that a universal 10% tariff could reduce 2026 S&P 500 earnings per share (EPS) by -5.2%.

Furthermore, as a consumer, you don’t want to see the added cost passed-on to customers because price increases – in aggregate across sectors and industries – can potentially lead to inflation. At this point, we’re all familiar with how damaging inflation can be.

Another potential risk of tariffs is tit-for-tat retaliation from other countries where foreign governments implement tariffs on U.S. exports. If a situation like this were to escalate, the U.S. could find itself in a trade war.

Having said all that, we fully advocate for supporting domestic producers & manufacturers. There just needs to be a very clear focus on the risk-reward dynamics and how universal tariffs, specifically, may impact global trade and inflation.

Potential Obstacles to Tariffs

To be clear, there is a tremendous amount of uncertainty that remains when it comes to the actual implementation of tariffs. As the old saying goes, ‘there’s many-a-slip between a cup and a lip’. This means that there are many obstacles that could prevent the Trump administration from implementing a universal 10% tariff on all foreign imports. For example, the U.S. is currently a party to the U.S. – Mexico – Canada Agreement (USMCA) which replaced the North American Free Trade Agreement (NAFTA) years ago. While the USMCA doesn’t outright prohibit new tariffs, it makes them much more difficult to implement.

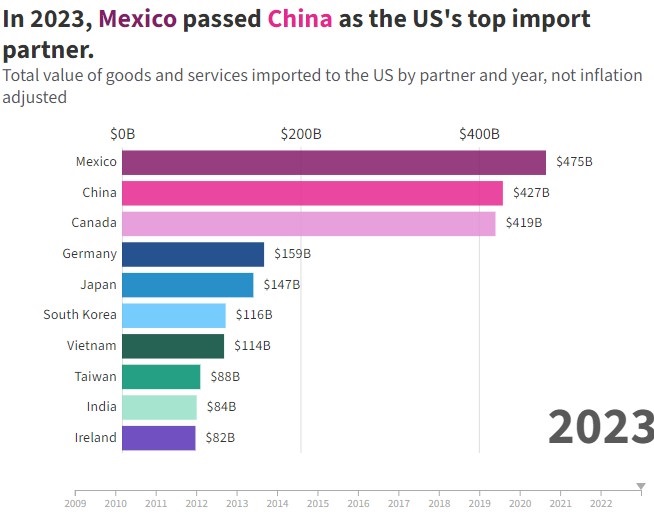

It’s also important to highlight the importance of America’s relationship with Mexico and Canada as valued trade partners. I’d wager that if I quizzed most people on the street and asked which country was the largest import partner of the United States, most would answer China. While that may have been the case years ago, we’ve seen imports from Mexico and Canada surge considerably in recent years, and Mexico has now become the United State’s largest import partner, as seen in the graph below.

Source: International Trade Administration – USAfacts.org

The point I’m trying to make is that there are many interested (and influential) parties at play here, including foreign governments, U.S. corporations/importers, foreign corporations/exporters, politicians, lobbyists, voters and more who all have a vested interest in how tariffs may or may not be implemented. Therefore, a lot of uncertainty remains when considering the path ahead for investors and attempting to understand which companies, industries, sectors or asset classes may be most impacted if tariffs are implemented.

One thing is clear – the United States is the strongest economy in the world and is the largest importer of goods & services. Therefore, the U.S. can potentially negotiate future trade deals from a position of strength. With his real estate background, Donald Trump tends to approach negotiations as transactional and tends to find ways to create leverage. A similar dynamic may be at play when it comes to talk of trade and tariffs.

My estimation is that if tariffs emerge, they may be a bit more targeted than currently implied given the risk of inflation and the power and influence of all interested parties. Should a more focused tariff strategy be implemented, this may greatly reduce the risk of inflation and a global economic slowdown due to tit-for-tat tariffs on U.S. exports.

Furthermore, while the COVID-19 pandemic had tragic health consequences, it also served as a lesson on supply chain logistics. Therefore, U.S. corporations are less reliant on singular trade partners and have diversified their supply chains, which has made the U.S. economy a bit more resilient to shocks in global trade. Of course, we’ll be watching very closely to better understand how the Trump administration handles trade policy and how it might impact financial markets. For now, there is very little actionable data available that might impact investment allocation decisions.

Tax Policy

While we’ve outlined some opportunities and risks around potential trade policy, we’ll now focus on an area that could provide some economic stimulus – taxes. Heading into the election, one law that remained somewhat uncertain was the status of the Tax Cuts and Jobs Act (TCJA), which had certain elements set to ‘sunset’ at the end of 2025. A Trump presidency tends to clear up much of that uncertainty, as Donald Trump touted the potential extension (or implementation) of the following tax features/benefits while on the campaign trail:

- Make the Following Tax Cuts & Jobs Act Features Permanent:

- Keep the top individual tax rate at 37%

- Maintain (or even raise) the child tax credit

- Keep the higher standard deduction

- Keep the higher estate tax exemption

- Maintain the increased AMT exemption

- Remove the $10,000 Cap on State & Local Tax (SALT) Deduction

- Exempt Social Security, Tips and Overtime Pay from Income Taxes

- End Electric Vehicle (EV) Tax Credits

- Lower the Corporate Tax Rate from 21% to 20%, and from 21% to 15% for Domestic Production.

From the perspective of stock market investors, lower corporate taxes can boost net profits, which is clearly a good thing. In fact, research indicates that the reduction in corporate taxes could boost corporate earnings by +4.7%. That is a meaningful number. While additional tax cuts may not emerge for many American citizens, tax filers should at least be able to maintain more pocketshare of their income than if many of the TCJA features were allowed to sunset. All things considered, the features outlined above could provide a stimulative effect on the economy, which is part of the reason why we saw the stock market react favorably in the immediate aftermath of the election.

From the perspective of bond market investors, however, the question then becomes, “well, how do you pay for this and what does it mean for interest rates?” All things being equal, lower taxes means less revenue for the government. Without additional revenue generation or offsetting spending cuts, smaller revenues means a greater federal deficit. A greater federal deficit requires even more borrowing. More borrowing requires the bond markets to absorb more and more U.S. debt each year. To absorb trillions of dollars in debt each year, global bond buyers may require higher interest rates. Higher interest rates, as we all know from the past 2-3 years, can impact the economy in many ways – some good, some bad – depending on your perspective.

Can the Trump administration cut enough spending (or raise additional revenues) to maintain, or even reduce, the federal deficit? Well, we’ll get into that initiative next.

The Department of Government Efficiency

For those of you who have been reading these investor letters over the years, you may know by now that I love to cook. When my family relocated to the east coast back in 2021, we purchased our current home because it was ideal for hosting friends and family. So, in November and December of each year, my wife and I will usually host a few holiday parties for which I might splurge and prepare a whole beef tenderloin. I like to buy the tenderloin whole and do any additional butchering and prep at home, as it’s typically a bit less expensive than getting it fully trimmed & prepped. With the right knives, this is usually very easy and involves trimming some excess fat and removing a thin layer known as the silverskin. At the end, I typically have a large tenderloin remaining with a few scant ounces of fat and silverskin that can be discarded.

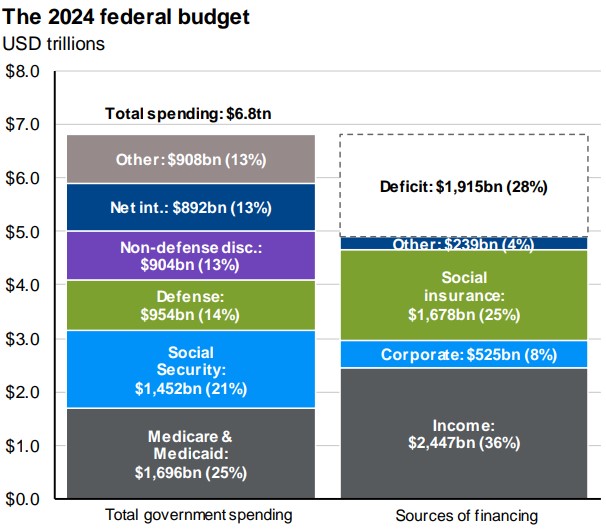

When I think about trimming the federal budget, I think about trimming a beef tenderloin. Yes, there may be small, wasteful bits of the federal budget that can be trimmed and easily discarded, but the meat of federal spending in the U.S. is on key areas like defense, Social Security, Medicare & Medicaid, and interest payments on current debt, as you can see in the chart below.

Souce: JP Morgan Asset Management – Guide to the Markets

So, of the $6.8 trillion federal budget in 2024, roughly $5 trillion – or 73% – of spending is seemingly off limits. That leaves ‘Other’ and ‘Non-Defense Discretionary’ spending from which expenses may be cut. Keep in mind that ‘Other’ includes items like military retirement, federal civilian retirement, health insurance subsidies and other income security programs. “Non-Defense Discretionary” includes education, transportation, energy & environment, law enforcement & justice, housing & urban development, veteran services, and more. Funding for these areas are determined by Congress through the annual appropriations process.

Regardless, to address federal spending and reduce government regulation, President-elect Donald Trump, has empowered entrepreneurs Elon Musk and Vivek Ramaswamy to create what they dub The Department of Government Efficiency.

According to a recent opinion piece released in the Wall Street Journal authored by Musk and Ramaswamy, they have vowed to utilize a combination of recent Supreme Court rulings and executive action to ‘cut the federal government down to size’, as stated in their letter. Musk and Ramaswamy estimate that they can help trim federal overspending by roughly $500 billion each year. Furthermore, they vow to examine federal contracts by conducting large-scale audits implemented during a temporary suspension of payments, which could add some savings. They specifically referenced the fact that the Pentagon recently failed its seventh consecutive audit in highlighting the need to reign-in wasteful spending.

This approach is somewhat unconventional, and is bound to face plenty of obstacles from government workers who face mass layoffs, to consumer/environmental protection advocates, Democrats, and more. This information is hot off the presses, as they say, and, as such, it’s difficult to assess any risks or opportunities for investors.

However, if you’ve previously read these monthly letters or watched our webinars in 2024, we’ve spoken ad nauseum about the ballooning U.S. public debt, the expanding federal deficits, and the increased cost of servicing the public debt which has become one of the single largest line-items in the federal budget. The proverbial can cannot continue to be perpetually kicked down the road, but it’s yet unclear what, if any, progress Elon Musk and Vivek Ramaswany can make when it comes to trimming spending and reducing the federal deficit. Therefore, it’s also very difficult to project what the associated risks or opportunities might be for investors. Clearly, this is another new element of the Trump administration’s agenda that we’ll be watching very closely.

Summary

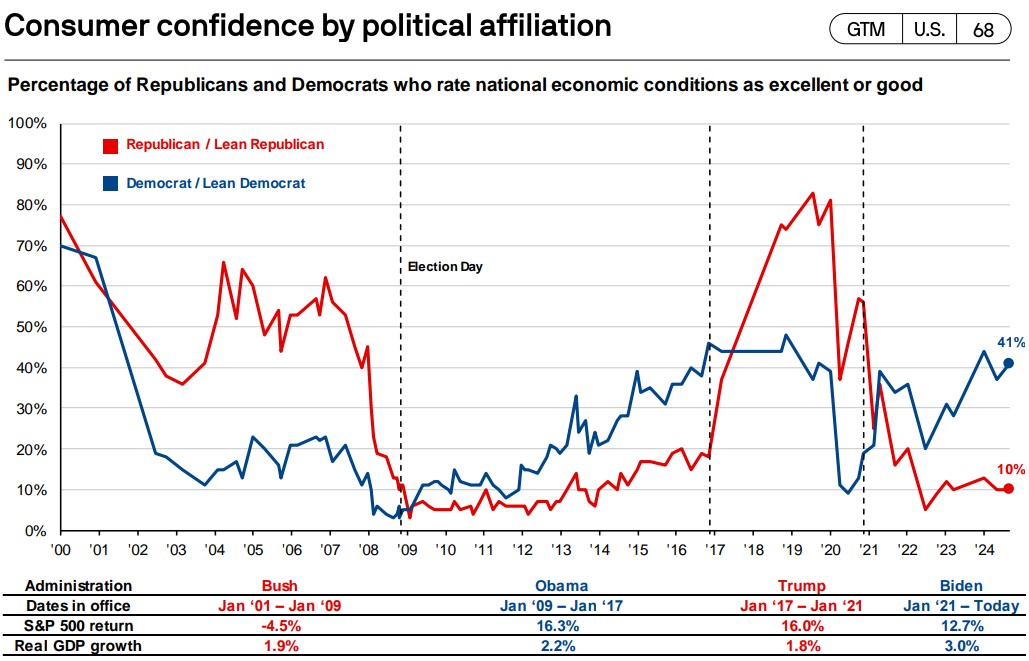

There is more we could potentially delve into including immigration, geopolitical conflict, the Federal Reserve and more, but I think it’s important to end by revisiting a chart that we shared at the beginning of 2024 knowing that we were heading into a contentious election year. This chart is based on a survey conducted by the Pew Research Center in which they ask respondents, “How would you rate the economic conditions in this country today, as excellent, good, only fair, or poor?” They then ask the respondents for their political affiliation/leaning. This chart shows the percentage of Democrats (Blue) and Republicans (Red) that rate the economy as excellent or good.

As you can see, Republicans tend to feel much better about the economy when a Republican candidate is in the White House, and Democrats tend to feel much more positive about the economy when a Democratic candidate is in the White House.

Source: Pew Research Center, JP Morgan Asset Management.

We may have many clients who were Harris voters that are feeling disappointed and despondent about the future of the U.S. economy right now. Conversely, we may have clients who are Trump voters that feel a sense of exuberance and optimism heading into 2025. To each side, I would caution against allowing emotion – either positive or negative – to drive investment decisions. I realize that this can often be easier said than done, but it’s important to remain disciplined as investors in order to ensure that you can reach your personal financial goals and maintain your desired quality of life over time.

It’s also important to note that investment returns will largely be driven by forces outside the periphery of the federal government. Time and time again, financial markets have proven to be incredibly resilient and are almost ambivalent to what’s transpiring in the world of U.S. politics. At Entrepreneur Aligned, our outlook for the U.S. stock market remains strong as the U.S. enters a new era of innovation that, among other things, has the potential to improve productivity and enhance corporate profitability. Of course, we will be closely watching any policies initiated by the new Trump administration in early 2025 to gauge what, if any, opportunities and/or risks may emerge as formal policy decisions are made. In the meantime, I hope you all have a wonderful Thanksgiving holiday, and please don’t hesitate to reach out to your Strategist or Coordinator with questions or concerns.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts