As children, my older brother and I were extremely fortunate to be raised by parents who were avid travelers. Not only were my parents adventurous when it came to both domestic and international travel, but they also found joy in sharing these experiences with their two young boys, and I’m confident that these trips helped to influence and mold the person I am today. While it was unfortunate that my father had to travel quite often due to his career, one silver lining was his seemingly endless accumulation of airline and hotel ‘points’ which helped to facilitate many of these family excursions.

However, over the years, I started to recognize a trend that emerged where family trips would occur either during the New Years holiday or immediately thereafter in early January. I came to find out that this yearly travel cadence was at the insistence of my father. As I grew older, my dad shared his reasoning with me, stating “after a busy year at work and the chaos of the Thanksgiving and Christmas holiday seasons, I know I just need a relaxing break to start the year fresh.” Now that I am a parent with my own busy career and two young children, I’ve come to learn that my old man was really onto something with that strategy.

I think investors feel much the same heading into 2024. We need a bit of a break, and a bit of a fresh start. We don’t necessarily need a break from investing. After all, 2023 was a positive year for nearly all asset classes. However, we could use a break from the seemingly constant adversity investors have faced in recent years.

We touched on this a bit in last month’s letter, but investors and consumers seem a little punch drunk after persevering through a frightening global pandemic, severe market volatility, soaring inflation, extreme Fed tightening, elevated interest rates, a historic bond market selloff, a banking crisis, geopolitical conflict including key U.S. allies and adversaries, and more. That’s quite a list, and this may help to explain why consumer confidence remains well below pre-pandemic levels as you can see in the chart below.

It’s clear that consumers (and many investors) remain a bit skeptical despite a resilient economy and ascending markets in 2023. The question then becomes – will 2024 be any different? Based on our data and assuming there are no ‘black swan’ surprises, 2024 could actually be a pretty – dare I say – boring year for investors. After the relative chaos of the past few years, doesn’t that sound wonderful?

What do we mean by ‘boring’? Well, based on projections, we could be looking at PCE inflation at 2%-2.5% by year end, GDP growth at roughly 2%, and unemployment in the 4% range. While those numbers seem rather tepid and unexciting, they would indicate that the U.S. may avoid both recession and a re-emergence of inflation, which would be welcome news for investors.

However, let’s not forget the elephant in the room as we move further into 2024. This is an election year, and politics are anything but boring these days. So, to start this month’s letter, we’ll briefly touch on any election implications for investors before moving onto financial markets, an earnings season preview, and an asset class that we’re particularly excited about moving into the new year.

Politics and Investing

With 24/7 news and social media, it seems as though election cycles are perpetual these days. Still, 2024 is a bit unique given that the U.S. will have a presidential election in November, and presidential elections tend to draw much more interest than midterm elections. In fact, the first caucus (Iowa) and primary (New Hampshire) are right around the corner, so we all get to look forward to a bombardment of political ads in the coming weeks and months.

Whenever key elections are on the horizon, we often get questions from investors who wonder what’s going to happen to their money if a certain party wins. The truth is that markets tend to be ambivalent to whoever is in the White House. Can there be investor consequences to political action (or lack thereof) if, say, Congress allows the U.S. to default on its debt obligations? Of course.

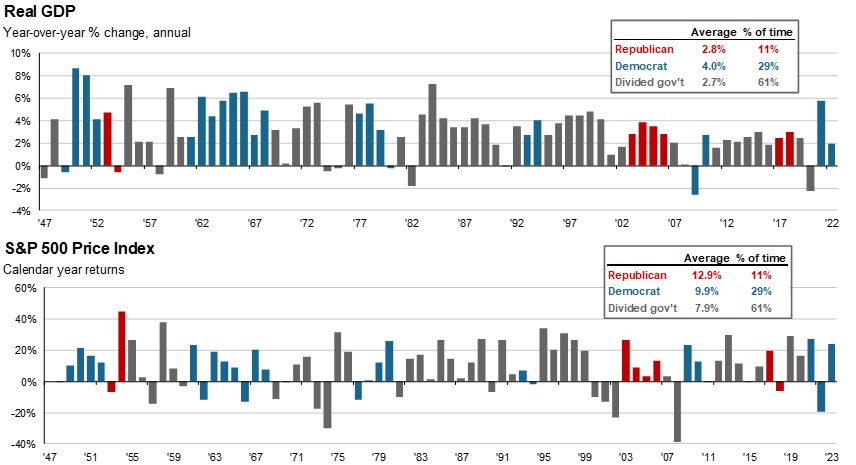

However, over the long run, the U.S. economy has grown and the markets have generally ascended regardless of who is in control of the federal government. This can be seen in the chart below with the top portion that shows Real GDP growth under Republican control (+2.8%), Democratic control (+4.0%) and under divided government (+2.7%). The bottom portion then shows S&P 500 index returns under Republican control (+12.9%), Democratic control (+9.9%) and divided government (+7.9) since 1947.

Source: JP Morgan Asset Management – Guide to the Markets

In my experience, elections and politics have less to do with domestic economics and investing fundamentals and more to do with behavioral finance. What do I mean by that? I mean that election results – namely, who’s in charge – can impact our perceptions about what’s going on in both the economy and financial markets.

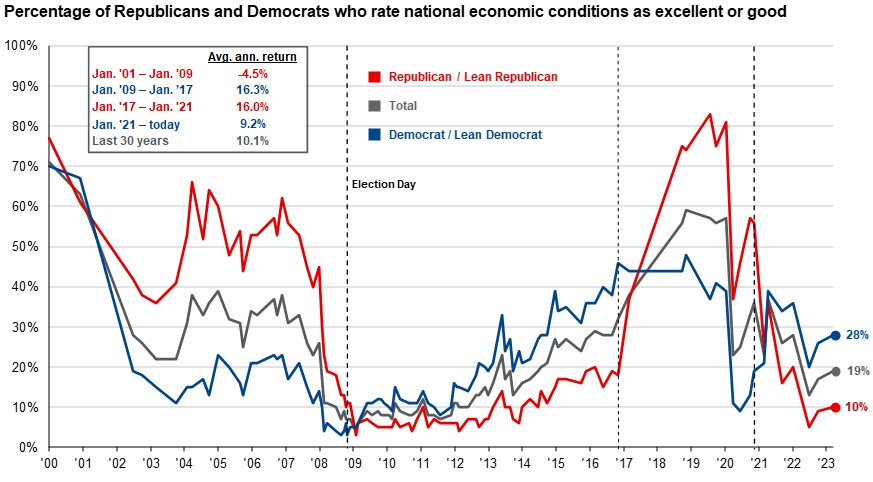

The chart below can help to illustrate this dynamic. There is an ongoing survey conducted by the Pew Research Center that asks respondents their political affiliation, then asks “how would you rate economic condition in this country today, as excellent, good, fair, or poor?” This chart then illustrates responses over time based on political affiliation with the red line representing Republican/Lean Republican and blue representing Democrat/Lean Democrat. The vertical dotted lines represent an election where a new party took over the White House.

Source: JP Morgan Asset Management – Guide to the Markets

2008/2009 aside (when everyone was miserable), it’s interesting to see how perceptions and opinions can shift after an election. Investors and voters often feel much more optimistic when ‘their team’ is in the driver’s seat.

Are there a few topics that we are observing closely from a financial planning & investor perspective when it comes to policy and messaging? Yes. Specifically, we’re interested to see the discussion around the Tax Cuts and Jobs Act (TCJA). If you recall, there are many provisions in the TCJA that are set to ‘sunset’ after 2025, including lower individual tax rates, the increase in the standard deduction, certain itemized deductions and so forth.

The implications of the TCJA are somewhat less important for investors, as the TCJA permanently changed the corporate tax structure which previously had a 35% top rate and now utilizes a flat 21% tax rate regardless of taxable income. This provision will not expire. However this TCJA conversation dovetails with our next area of interest – debt and spending.

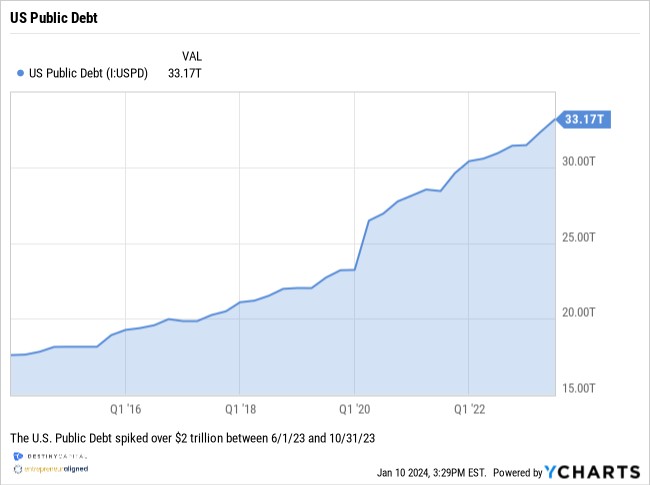

If you’ve read any of our investor letters or watched our monthly webinars, you’ll know that debt and spending is something we’ve discussed quite a bit over the past few months. This is largely due to the unexpected spike in debt levels where the U.S. Public Debt rose over $2 trillion between June and October of 2023 to a total of $33.17 trillion as of the end of Q3 2023.

Is this debt an existential and immediate threat to the United States? Not necessarily. After all, Japan’s debt-to-GDP ratio has exceeded 200% for many years whereas debt-to-GDP in the U.S. is roughly 120%. I am not insinuating at all that the U.S. should follow Japan’s lead when it comes to this trend, but to show that higher levels of debt does not spell immediate doom for the United States.

However, we are curious to see if there will be plans to address debt and spending in this election cycle. As interest rates remain elevated and if spending trends continue, debt servicing (interest payments to borrowers) will replace Medicare and Medicaid as the largest annual expense for the U.S. Government in just a few short years.

Market Update & Earnings Focus

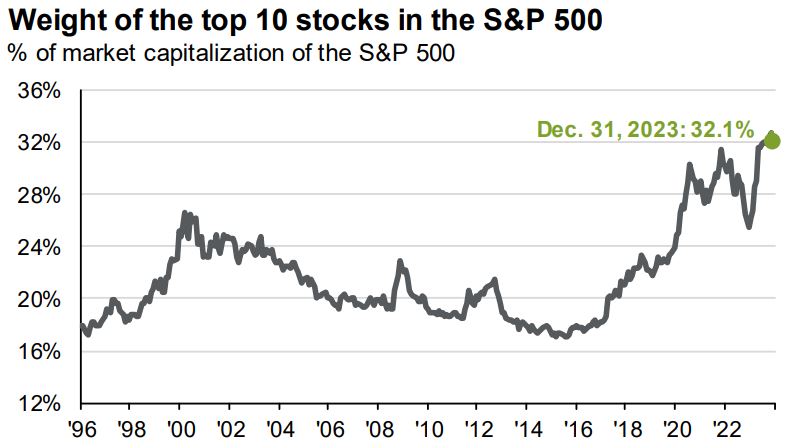

As we head into Q4 earnings season in the coming days, we expect one unique 2023 trend to continue into 2024, and this is the market’s focus on a select few mega cap stocks. The S&P 500 is historically top-heavy, meaning that the top 10 holdings of the S&P 500 make up over 32% of the overall index. This dynamic can be seen in the chart below.

Source: JP Morgan Asset Management – Guide to the Markets

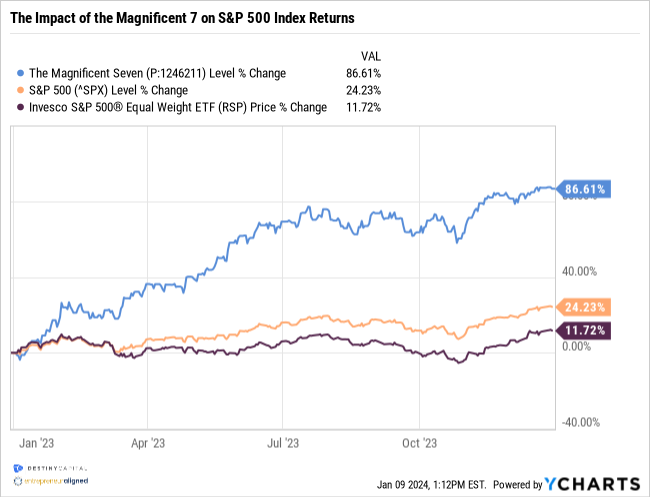

In 2023, the top seven S&P 500 companies (Apple, Microsoft, Amazon, NVIDIA, Tesla, Meta, & Alphabet) had a combined annual return of 86.6%, led by NVIDIA (+239%), Meta (+194%) and Tesla (+101%). These returns largely drove the 24.2% year-to-date return of the S&P 500 as a whole. However, if you strip-out those top-heavy stocks by looking at the S&P 500 on an equal-weighted basis, then the index only returned 11.7% last year, as you can see in the chart below.

Based on these performance dynamics, you can bet that investors are going to be keenly focused on the earnings of these select few mega cap stocks in 2024. If one or more of these stocks slip-up during quarterly earnings, it could cause volatility across the entire market – at least in the short-term. Microsoft is up first, reporting Q4 earnings on January 22nd. We then get Tesla soon after on January 24th, then an important day on January 31st as Apple, Alphabet, Meta and Amazon all report on Q4 earnings.

Excitement Around Alternatives – Direct Corporate Lending

We sometimes get the question, “what is an alternative investment?” If you ask 10 investment managers that same question, you may get 10 slightly different responses. At Entrepreneur Aligned, we essentially view ‘alternatives’ as anything outside of publicly traded stocks and bonds. So, that’s a pretty broad universe that might include asset classes like gold or other precious metals, commodities, venture capital, private real estate, private equity, hedge funds, and more.

When Entrepreneur Aligned conducts its annual capital market assumption (CMA) review, we attempt to identify asset classes that may enhance client portfolios from a risk/return perspective. This CMA review not only includes a variety of stock and bond asset classes, but alternative asset classes as well. While some alternative asset classes have appealing risk/return profiles, they also come with high barriers to entry for most investors.

These barriers include accredited/qualified investor restrictions, meaning that investors must meet certain income and/or net worth thresholds in order to invest. Other barriers include very high fees, liquidity restrictions (including redemption penalties), very high minimum investments, complex investment structures, tax complexities and so forth. As such, it is difficult, if not impossible, to obtain efficient and cost-effective access to certain alternative asset classes.

This dynamic, I am happy to say, is changing. Over the past five years, one particular asset class – Direct Lending – has caught our eye in each annual CMA review. Direct Lending is an asset class that focuses on private market loans made to middle-market corporations that are typically short in duration (3-years), floating rate, and senior secured (backed by assets). These loans are originated by the manager (i.e. the direct lender) and not a bank or a traditional intermediary. Historically, Direct Lending has provided very strong returns with low volatility relative to most other asset classes.

At Entrepreneur Aligned, we list ‘Innovation’ as one of our core investing principles. The world of investing is constantly evolving with new tools, technologies, asset classes, strategies, and investment vehicles emerging on a perpetual basis. Therefore, it’s important to remain at the forefront of these innovations so we can uncover investment opportunities that will enhance risk-adjusted returns for our investors.

This has been the case with an alternative asset class like Direct Lending, where we’ve identified an investment manager and an investment vehicle that removes many of the barriers to entry (high fees, high minimums, complex structures, tax complexities, etc.) that exist for most alternative assets. Many Entrepreneur Aligned investors will receive more individualized communication around this investment opportunity, but it’s important to reiterate that our due diligence is extensive, and our work in uncovering unique and exciting investments never ceases.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.