How Do Beneficiary Designations Work?

What are beneficiary designations?

A beneficiary designation is the process of naming a person or entity that will inherit an asset upon your passing. Beneficiaries can be named in estate planning documents, such as a will or a trust, but they can also be added to individual assets, including financial accounts, life insurance policies, real estate, and other assets.

Beneficiary designations that are directly added to assets usually take precedence over the instructions outlined in a will and avoid the “probate” process altogether. Probate is the formal court-supervised process of determining whether a decedent had a valid will and who will be responsible for distributing assets to beneficiaries. However, assets with beneficiaries specifically named typically bypass this step. For example, if you add a beneficiary designation to your IRA, the balance will transfer to that beneficiary when you pass regardless of what your will may say.

Not only is it important to add the proper beneficiaries to your accounts from the get-go, but it is crucial to ensure they are kept up to date. We regularly review beneficiary designations on accounts under our management and recommend that clients review all of their outside accounts and policies as well. Over the years, we have identified numerous issues with beneficiary designations that would have created unwanted consequences had clients not taken action. In one instance, an individual still had an ex-spouse named as primary beneficiary on a retirement account while already remarried. On another occasion, an individual had only named one child as beneficiary and never made updates as their family grew.

How do beneficiary designations work?

There are typically two types of beneficiaries named: primary and contingent. A primary beneficiary is the first person or entity you would like to inherit your property and a contingent beneficiary is the backup in case the primary beneficiary passes before you.

Some important things to note:

- If your primary beneficiary outlives you, they will receive the asset and your contingent beneficiary designation is not executed upon.

- Once a beneficiary inherits an asset, it becomes their asset, and they can leave the remainder to whomever they wish. Some mistakenly think that when they pass, their assets will pass to their primary beneficiary, and then when the primary beneficiary passes, the asset is then transferred to the contingent beneficiary. However, except for some trusts, this is not true.

- As an example, if you name your spouse as primary beneficiary of your IRA and your children as contingent, your spouse will inherit the account at your passing if they outlive you. At that point, they can name any beneficiary they choose on their newly inherited balance.

Here is a basic example:

Let’s assume Bob and Betty are married and have two children – Jack and Jill. Bob names Betty as primary beneficiary of his IRA, and then his two children as contingent beneficiaries equally. As long as Betty outlives Bob, she will receive his IRA balance. After that, she has the ability to name her own primary and contingent beneficiaries, which may exclude Jack and Jill.

Alternatively, if Betty passes before Bob, Jack and Jill will receive Bob’s IRA balance when he passes away.

Additional Elections: “per stirpes” vs. “by representation” vs. “per capita”

To further specify your wishes, there are additional elections that can be added to beneficiary designations to account for a scenario where all or some of your named beneficiaries pass before you. The terms for these elections are “per stirpes,” “by representation,” and “per capita,” and they each work a bit differently depending on your wishes.

These elections can be a bit complicated, so we will illustrate each with another example:

John and Jane were married for many years, but John passed away several years ago. They had four children – Alan, Beth, Charles, and Denise. After John’s death, Jane named the four children equally as primary beneficiaries on her IRA. Let’s assume that Alan has two children, Beth has no children, Charles has three children, and Denise has two children. We will also assume that Charles and Denise have also passed away in recent years.

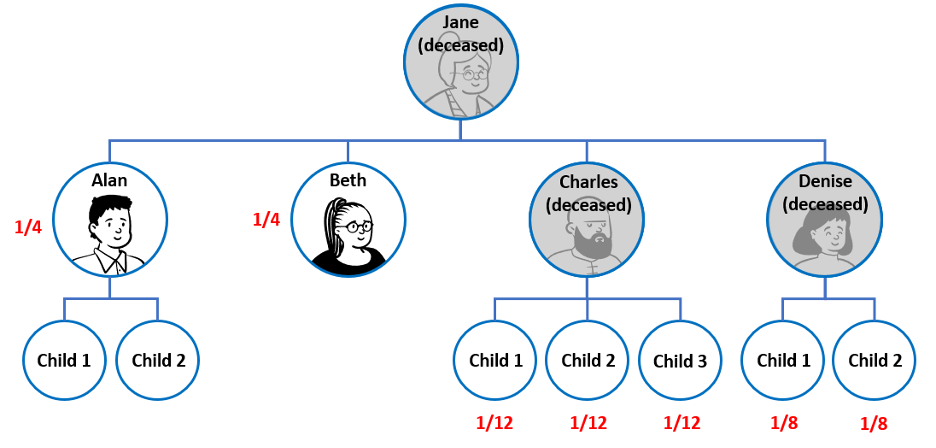

Per Stirpes

Per stirpes is a Latin term, which means “by roots” or “by branch.” When added to a beneficiary designation, this specifies that if your beneficiary passes before you, their share of the asset is equally divided among their descendants.

In this example, if Jane had named Alan, Beth, Charles, and Denise as primary beneficiaries, per stirpes, Alan and Beth would receive one-fourth of Jane’s IRA each, Charles’s children would divide his one-fourth share, and Denise’s children would divide her one-fourth share.

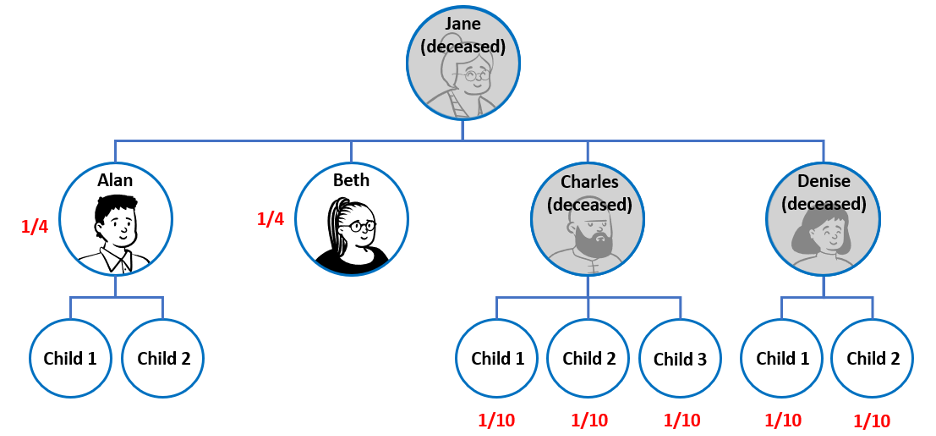

By Representation

By representation means that surviving members of each generation are treated equally. For example, if you name your children as your beneficiaries, by representation, and one child predeceases you, their children (your grandchildren) equally inherit the predeceased child’s share. This is similar to the per stirpes designation. However, here is where it differs: In the same example, if more than one of your children predeceases you, each leaving children of their own, all of your surviving grandchildren receive an equal portion.

For example, if Jane had named Alan, Beth, Charles, and Denise as primary beneficiaries of her IRA, by representation, Alan and Beth would still receive one-fourth each, but Charles and Denise’s children will divide the other one-half of Jane’s IRA balance equally, leaving them with a 1/10 share.

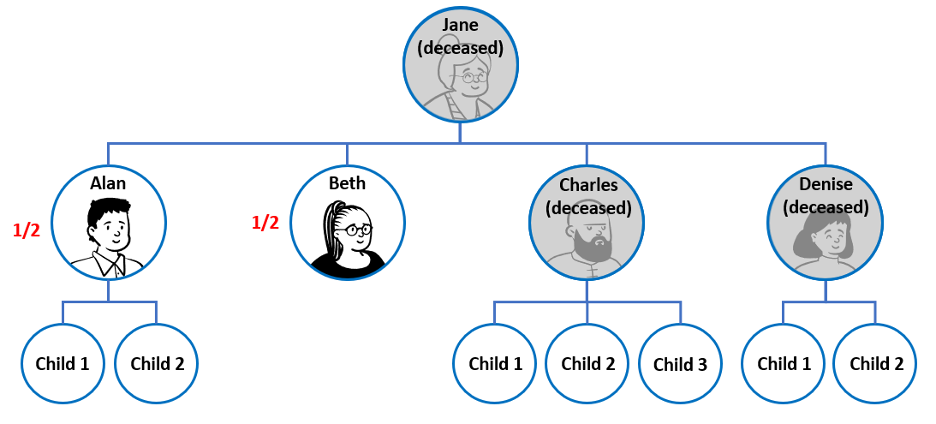

Per Capita

Per capita is another Latin term meaning “by head.” This election specifies that if one of your beneficiaries passes before you, their share of the asset is distributed evenly among the other surviving beneficiaries at the same level.

If Jane named Alan, Beth, Charles, and Denise as primary beneficiaries of her IRA, per capita, Alan and Beth would each receive one-half of the balance. Charles and Denise’s children would receive nothing.

Without understanding how your beneficiary designations work relative to your unique family situation and the options available to you, mistakes can easily be made. This is why we periodically review beneficiary designations and discuss them with our clients to ensure they are still in alignment with clients’ wishes, and we do occasionally identify items that clients choose to update due to changes in family circumstances, financial condition, state of residency, or state and federal laws.

If you have questions about your beneficiary designations or just want to confirm that your designations still meet your goals, we invite you to contact us. Our team is happy to meet with you to review your entire estate plan, and we can help make updates to beneficiaries if needed.

If you have a question or simply want to talk through your financial planning, we are here to help.

GET IN TOUCH WITH US: EA Quick Message or call 720-715-7570

DISCLOSURE: Adam Burch is an officer of Destiny Capital and Entrepreneur Aligned, a DBA of Destiny Capital. This article is for informational purposes only and should not be relied upon as a basis for your investment, business, or personal financial decisions. We recommend consulting with your wealth advisor, CPA/tax advisor and/or attorney, as applicable to your situation, prior to implementing any new tax, legal, or investment strategy. Advisory services provided by Destiny Capital Corporation, a Registered Investment Adviser.

ABOUT ADAM

As your trusted advisor, Adam partners with you to turn aspirations into reality. By gaining a profound understanding of your complete financial picture, Adam develops a personalized financial roadmap in collaboration with you. This roadmap acts as a blueprint, guiding us toward accomplishing your goals while seeking out avenues for growth, tax optimization, and risk mitigation. Throughout this entire process, Adam’s goal is to help you be successful in the pursuit of a truly remarkable life.

Adam has over a decade of experience serving clients as a Financial Planner, Lead Advisor, and Director of Financial Planning. Prior to that, he spent several years with a Fortune 500 company providing valuable financial insight for high-profile corporate initiatives. With a genuine passion for the dynamic field of financial planning, Adam thrives on crafting innovative strategies that align with each client’s objectives while connecting deeply with them on a personal level.